Evolve Back Transforms Booking and Payment Allocation with Creviz Custom Allocation Management Software

Key Highlights

Evolve Back Resorts

When world-class hospitality meets complex operational workflows, only a truly custom software solution can bridge the gap.

Evolve Back (formerly Orange County Resorts), one of India's most luxurious resort brands, operates three stunning properties across Coorg, Kabini, and Hampi. With over 200+ keys and cottages and a network of 300+ travel agents, Evolve Back delivers exceptional guest experiences - but behind the scenes, the finance and sales teams were struggling with a persistent challenge: payment allocation and reconciliation across multiple channels.

Through Creviz's Custom Allocation Management Application, Evolve Back was able to automate and streamline how payments from travel agents, direct guests, and bank transfers were tracked, verified, and allocated - achieving an 80% improvement in efficiency and eliminating manual coordination between teams.

About Evolve Back

Evolve Back is synonymous with refined luxury and authentic local experiences. Known for its immersive resorts in Coorg, Kabini, and Hampi, the brand combines architectural elegance, responsible tourism, and heartfelt hospitality.

Each Evolve Back property offers a range of accommodation types - from private pool villas to luxury cottages - and caters to guests through direct online bookings, partner travel agents, and corporate collaborations.

The chain uses Oracle Opera, a global hospitality ERP, as its primary property management system (PMS) for tracking reservations, room inventory, and guest stays. While Opera is robust for reservation management, it wasn't equipped to handle the payment verification and allocation workflows unique to Evolve Back's ecosystem - especially for bank transfers and agent-led bookings.

The Challenge: Manual Payment Verification and Allocation

Evolve Back's operational model involved multiple booking sources and payment modes - a complexity that grew as the brand expanded its footprint.

Here's how their process used to work before the Creviz solution:

- Travel Agent Bookings and Bank Transfers

- Over 300+ registered travel agents frequently booked rooms for their clients.

- Many agents preferred to pay via direct bank transfers instead of online gateways to avoid transaction fees.

- Even some direct guests used bank transfers for the same reason.

- Lack of Payment Visibility in Oracle Opera

- Since Oracle Opera couldn't automatically capture payments received via bank transfer, sales agents had to manually confirm each payment with the finance/accounting team.

- A sales agent would email the finance team with booking details.

- Finance would download the daily bank statement, search for the transaction by description or ID, and confirm receipt.

- If the description didn't match or multiple payments came from the same agent, several back-and-forth conversations were required.

- Only after manual confirmation could the booking be marked "confirmed" in Opera.

This manual loop caused:

- Delays in confirming reservations, especially during peak seasons.

- Errors in fund allocation - over-allocation or under-allocation.

- Heavy email dependency between sales and finance teams.

- Increased workload on finance staff, where typically 1 accountant had to support 20+ sales agents.

- Complexity with Modifications, Refunds, and Credit Vouchers

- Evolve Back's operations also included guest modifications, cancellations, and refunds - which added another layer of manual effort.

- Guests could cancel or modify bookings paid via bank transfer or gateway.

- Refunds required verification, deduction of retention fees, and HOD approval.

- Sometimes, Evolve Back would issue credit vouchers (instead of refunds) for guests to use later.

- If the guest never utilized the voucher, a refund of the voucher amount had to be processed manually.

- All these actions - unallocations, partial refunds, or credit creation - required updates in Opera, email approvals, and multiple handoffs.

- End-of-Week Financial Reconciliation

- At the end of every week, the finance team had to:

- Download complete bank statements.

- Match transactions with Opera booking reports.

- Calculate total booking value, advances received, revenue realized, and refunds issued.

- Identify mismatches and pending allocations manually.

- This time-consuming, error-prone task required constant coordination between:

- Sales Agents

- Finance Team

- Sales and Finance HODs

- Despite everyone's best efforts, the process often led to inefficiencies, data mismatches, and delayed reporting.

- At the end of every week, the finance team had to:

The Turning Point: Evolve Back Partners with Creviz

Recognizing the operational bottlenecks, Evolve Back collaborated with Creviz - a technology company known for building custom software applications that integrate seamlessly with existing enterprise systems like Oracle Opera.

Seamless Integration with Oracle Opera

Creviz Proposed Solution

Creviz proposed a Custom Allocation Management Application designed specifically to:

- Automate payment verification and allocation - Eliminate manual bank statement checks and email confirmations

- Sync with Opera's booking data in real time - Ensure immediate updates across both systems

- Enable secure collaboration between finance and sales teams - Streamline communication with built-in workflows

- Simplify refunds, unallocations, and credit voucher processing - Automate complex financial operations

- Provide complete transparency and audit trails for management - Full visibility into all financial transactions

This strategic partnership marked a significant shift from manual, error-prone processes to an automated, integrated financial ecosystem that would transform Evolve Back's revenue management operations.

Solutions Implemented

The custom Allocation Management Software designed by Creviz serves as the central bridge between bank statements, booking data, and Opera PMS, effectively closing the information gap between departments.

Below is a breakdown of each feature implemented and the impact it created across departments.

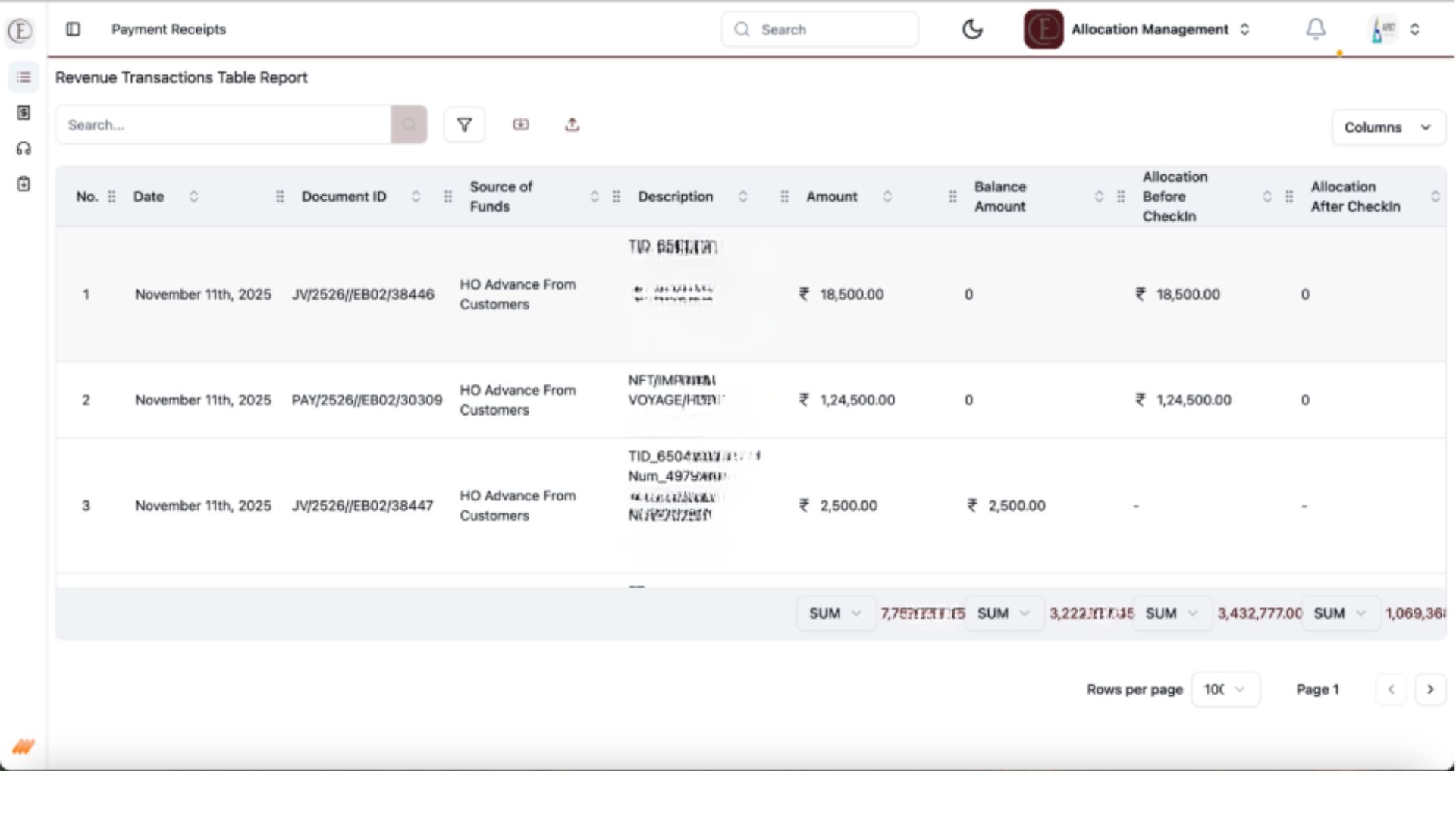

1. Automated Bank Statement Upload & Notification

- The Finance/Accounting Team uploads bank statements periodically (daily or multiple times a day).

- The system automatically parses and categorizes each transaction.

- Sales Agents are notified in real-time when new payments are uploaded.

- No more email follow-ups or manual requests - everyone works with the same live data.

Automated Bank Statement Upload & Notification

Finance team uploads bank statements, system automatically parses transactions, and sales agents get real-time notifications for payment confirmations

Image preview

"Earlier, our team had to manually cross-check every bank transaction. Now, uploads and alerts happen automatically it's saved us hours every day."

- Accounts Executive, Evolve Back

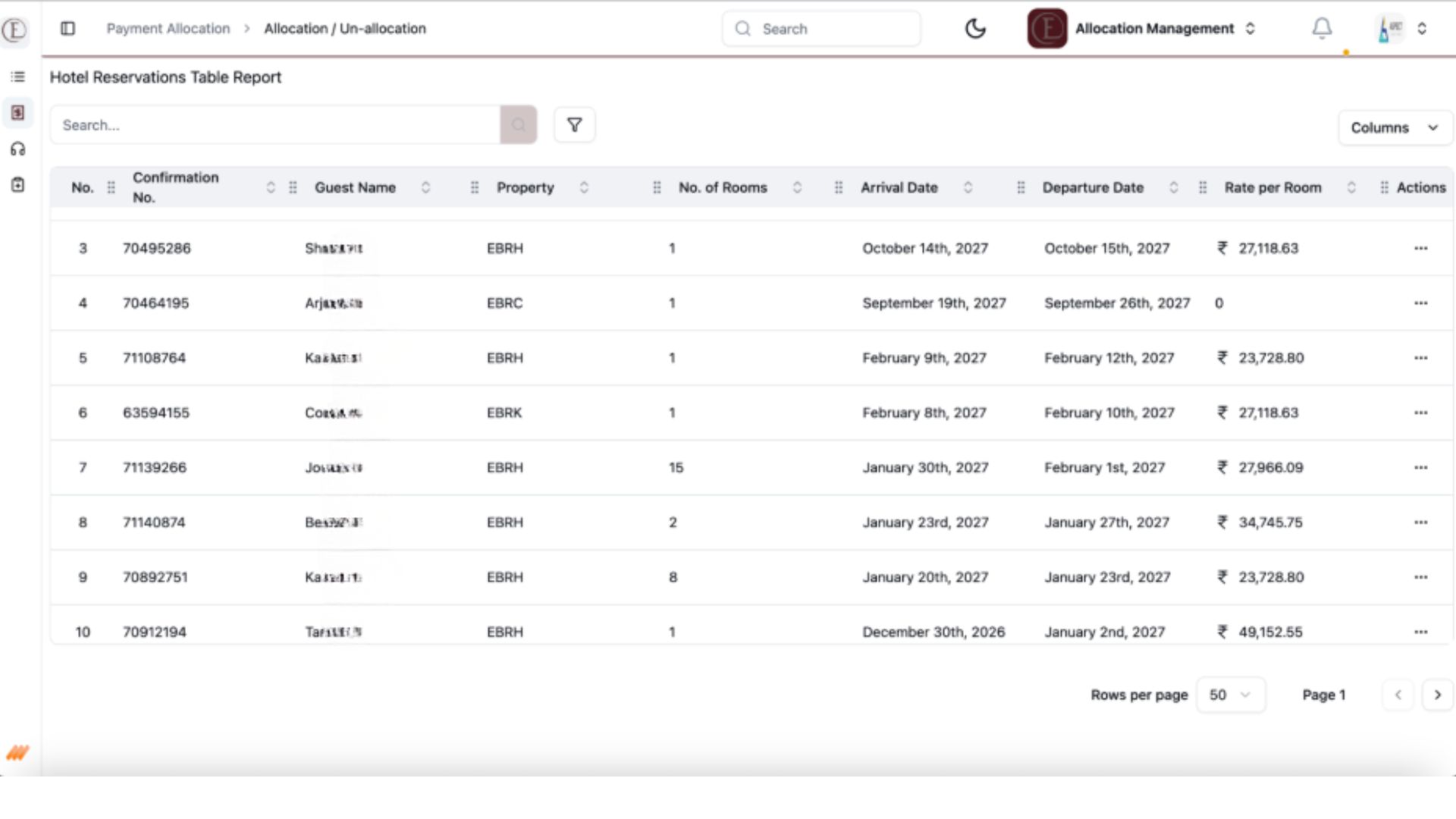

2. Real-Time Reservation Sync from Opera

- The system is integrated with Oracle Opera APIs to fetch the latest reservation details.

- Sales agents can see all active and pending bookings linked directly to their clients and travel agents.

- This allows agents to identify which payments correspond to which reservations quickly and accurately.

Real-Time Reservation Sync from Opera

Seamless integration with Oracle Opera PMS to fetch live reservation data and sync allocation updates instantly

Image preview

"Being able to see live reservations from Opera alongside payment data means no more delays or confusion. Our confirmations are instant now."

- Sales Agent, Evolve Back

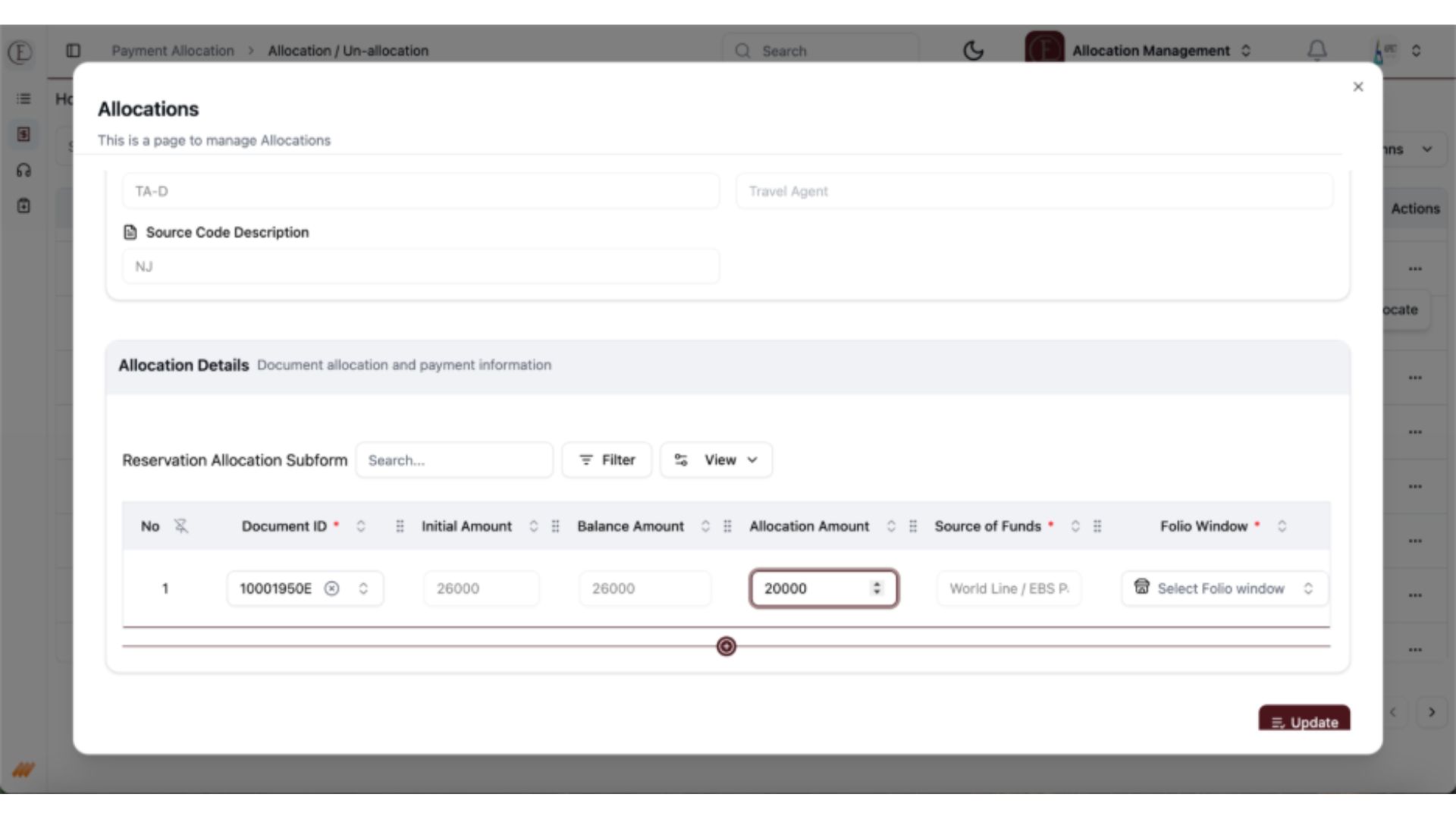

3. Payment Allocation & Unallocation in One Click

- Sales agents can allocate or unallocate payments directly from the interface.

- Allocations are instantly updated in Opera, ensuring both systems remain perfectly in sync.

- The smart validation logic ensures there are no wrong allocations, over-allocations, or under-allocations.

Payment Allocation & Unallocation in One Click

Sales agents can allocate or unallocate payments with smart validation and instant Opera synchronization

Image preview

"Allocations used to be a nightmare of mismatches. With Creviz, one click does it all-accurate, validated, and synced with Opera."

- Senior Sales Coordinator, Evolve Back

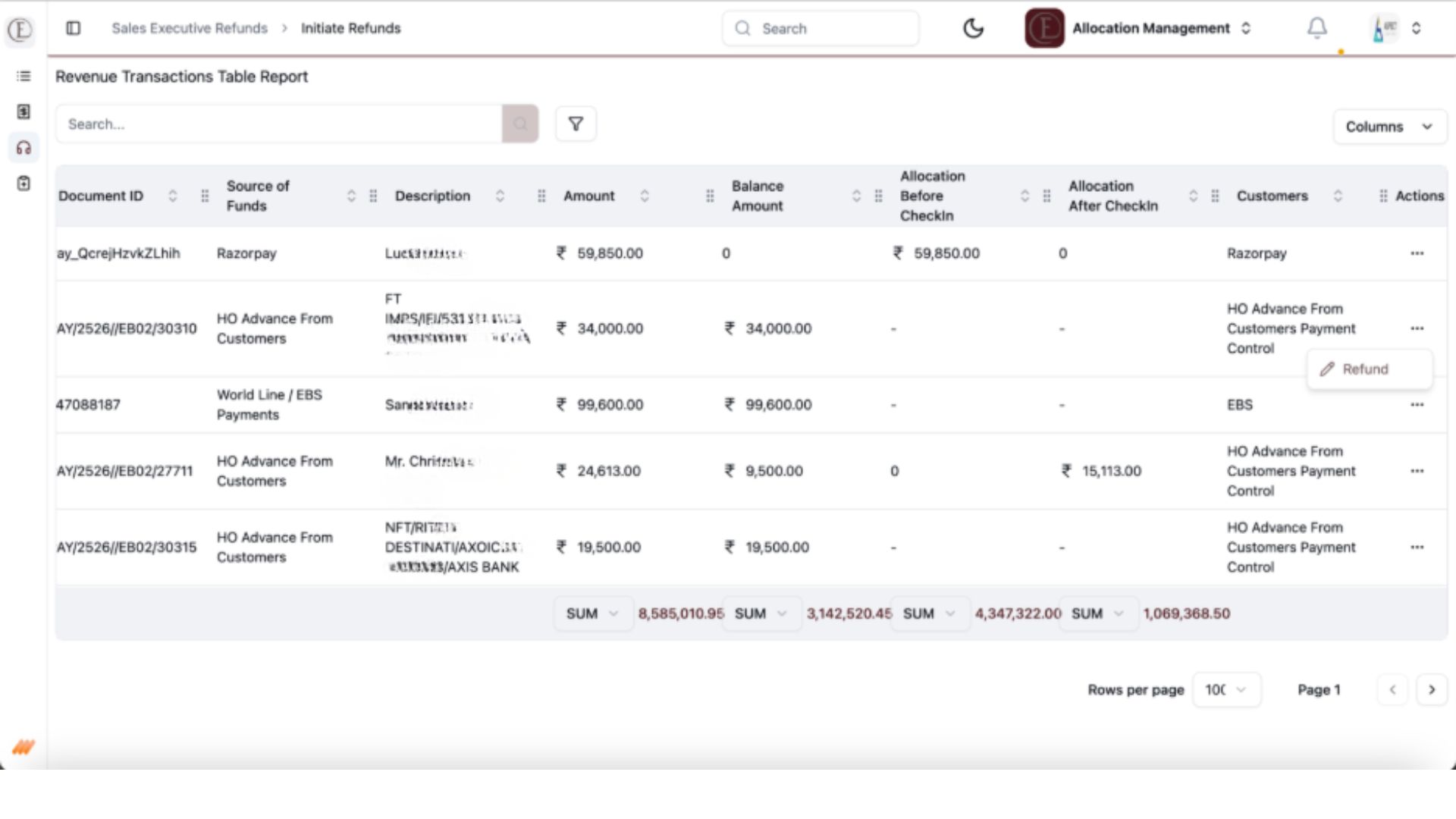

4. Refunds & Credit Vouchers Simplified

- Sales agents can initiate refunds or credit voucher creation directly within the application.

- The system supports both partial and full refunds, automatically calculating retention fees.

- Credit vouchers can be tracked, modified, or refunded later if unused.

- Approvals from Sales HODs and Finance HODs are handled digitally, with full audit trails.

Refunds & Credit Vouchers Simplified

Complete workflow for processing refunds, creating credit vouchers, and managing approvals with full audit trails

Image preview

"Refunds and vouchers were the most error-prone tasks. The new system handles everything-from retention fees to approvals-without endless emails."

- Finance Officer, Evolve Back

5. Unified Financial Dashboard for Both Teams

- The Finance and Sales Teams have access to identical real-time dashboards.

- Key metrics include total payments received, allocations made, revenues realized, refunds processed, and credit vouchers issued.

- The dashboards are accessible by HODs for oversight and decision-making.

"Both our teams now work on the same dashboard. We can see payments, allocations, and pending items in real time. Total transparency."

- Sales Head, Evolve Back

6. Smart Reconciliation and Reporting

- At the end of each week or month, the finance team can instantly view matched and unmatched transactions.

- The system generates reports comparing total deposits, booking values, refunds, and retained revenue.

- Discrepancies are flagged automatically - eliminating hours of manual Excel work.

"Our weekly reconciliations used to take half a day. Now, it's just a few clicks. The system even flags mismatches automatically."

- Finance Manager, Evolve Back

Results: 80% Increase in Allocation Efficiency

After implementing Creviz's Custom Allocation Management Software, Evolve Back experienced measurable operational improvements:

| Metric | Before Creviz | After Creviz |

|---|---|---|

| Payment Confirmation Time | 2-3 email exchanges | Instant (real-time) |

| Allocation Accuracy | Error-prone | 100% validated allocations |

| Refund & Credit Voucher Handling | Manual and slow | Automated with approvals |

| Finance-Sales Coordination Weekly Reconciliation Time | High dependency 4-5 hours | Self-service + alerts < 1 hour |

| Allocation Efficiency | Improved by 80% |

Client Feedback

"Creviz's custom allocation software has completely changed how our sales and finance teams coordinate. We've eliminated manual errors, improved speed, and now have complete clarity on every rupee received and allocated. The integration with Opera is seamless, and the workflow fits exactly how we operate."

- Finance Head, Evolve Back Resorts

Why Custom Software Development Was the Right Choice

Generic ERP and PMS systems like Oracle Opera are powerful but not built to handle unique financial workflows such as: multi-source payment reconciliation, manual bank transfers, credit voucher management, and department-level approvals.

Evolve Back's case illustrates the importance of custom software development - not as a replacement for existing systems, but as a strategic extension that enhances their capabilities.

Creviz's custom application development approach ensured:

- Deep understanding of Evolve Back's internal processes

- Seamless integration with Opera and existing financial tools

- Intuitive UI for non-technical users

- Adaptability for future use cases (multi-property scalability, new payment gateways, etc.)

Conclusion

The partnership between Evolve Back and Creviz demonstrates how custom software solutions can solve industry-specific operational challenges that standard tools cannot.

By implementing a Custom Allocation Management Application, Evolve Back successfully automated complex financial workflows, bridged communication between sales and finance, and improved efficiency, accuracy, and transparency.

Today, the Evolve Back team operates with confidence, clarity, and control - proving that with the right custom application, even the most intricate operations can be simplified and scaled.